The Big Picture on the 2019-20 PreK-12 Market

Adoptions, non-adoptions, civics, SEL, career-ready education, and the possible recession. According to Kathy Mickey, Senior Analyst of Simba Information, all of these could impact the instructional materials marker. In her recent presentation “K-12 Instructional Materials: What’s New in 2019,” she previewed results from Simba’s Publishing for the PreK-12 Market, 2019-2020, and talked about how digital is changing—and not changing—the landscape.

Report highlights

- Basal products are still expected to be one of the largest selling products, but that’s because of how they have mushroomed. Rather than a single book or set of books, most basal programs now include a number of materials to facilitate learning. And even if the main product is print, the additional resources often include digital components.

- Supplementals come in a variety of formats as well. More important, teachers are stringing together groups of supplemental resources to create their curricula. This includes teachers sharing lessons with each other within and outside of their districts. In addition, the number of schools and districts using OER continues to rise.

- Regarding the digital shift, ELA and literacy materials are still mainly print with digital supplements. With the continued emphasis on reading at grade level by third grade, schools are looking for their elementary materials to focus on phonics.

- Math and science, on the other hand, are more likely to be digital. Also, because of issues like climate change and other current issues, science teachers often pull together their own materials. (This happens with social studies too.)

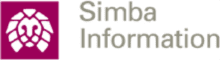

- While not necessarily high volume, there are some other instructional areas gaining ground: STEAM, civics, career and technical education,and social-emotional learning (SEL). Mickey said that there have been bursts of interest in SEL programs in the past, but she thinks their longevity depends on integrating them with other subjects rather than as stand-alone materials.

- No matter what the subject, though, every publisher should be ready to share their student data privacy standards for their digital tools.

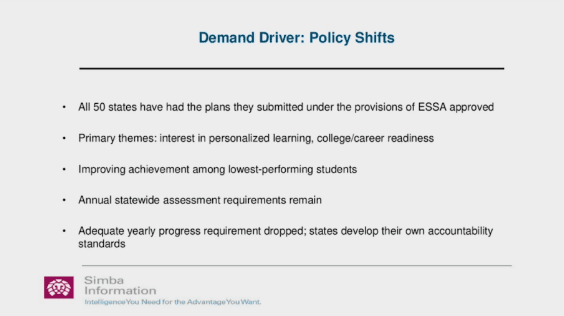

- Previously, about half of the students in the United States were in adoption states, but the number of pure adoption states has decreased. Many states may still review materials, but even then schools have discretion. California, Texas, and Florida are still adoption states, though, and with their large student populations, it’s still good for publishers to get on their lists.

- In addition to statewide adoption, many states not have regional consortia. Mickey has heard principals tell publishers not to email them if they don’t already have a relationship with the school. Instead, publishers need to contact the consortium and start there.

Of course, states are investing in technology devices and infrastructure, but also in data-driven learning. This means that when administrators make purchasing decisions, their goal is to get materials to facilitate learning for all students and their individualized education needs. A key driver in those purchasing decisions can come from classroom data, said Mickey, as teachers provide information to show them what materials the students need.

The edWebinar referenced above was sponsored by Simba Information, a business of MarketResearch.com.

This article was modified and published by EdScoop.

About the Presenter

Kathy Mickey is Senior Analyst and Managing Editor of the Education Group at Simba Information, where she leads research on the preK-12 and college education markets. Kathy writes the bi-weekly B2B business intelligence newsletter Educational Marketer and works on a number of annual market forecast reports. She joined Simba in 2000 after many years as a reporter and editor at weekly and daily newspapers, where her focus was education.

Join the Community

EdFocus: The Edtech Industry Community is a free professional learning community on edWeb.net that will help you connect with colleagues in the education industry to share information and resources, raise questions, and get advice.

Comments are closed.